Your cart is currently empty!

Ignore Six Sigma at Your Peril

The Jan. 22, 2001, issue of Fortune contained an article that offered readers risky advice–namely, that Six Sigma could be ignored without adverse consequences.1 Don’t believe it.

To be fair, the article is directed toward investors, not managers. The author’s point is that Six Sigma alone won’t make a company successful. On that, I am in total agreement. In fact, I made the same argument in “Why Six Sigma Is Not Enough” post. However, the Fortune article presents a frontal assault on Six Sigma per se, and it includes so many errors, omissions and logical fallacies that the unsuspecting leader might be led to believe that his or her company would be better off without Six Sigma. This mistaken conclusion could cause serious harm to such leaders’ companies, as well as their own careers.

In addition to the superficial arguments against Six Sigma (e.g., “Six Sigma can get downright silly”), the article levels some serious criticisms against its deployment:

- While impressive at the Black Belt level, the results often don’t have any noticeable impact on company financial statements. Thus, Six Sigma success doesn’t correlate to higher stock value. This applies to 90 percent of the companies that implement Six Sigma.

- Only early adopters can benefit.

- Six Sigma focuses on defects, which are hard to objectively determine for service businesses.

- Six Sigma can’t guarantee that your product will have a market.

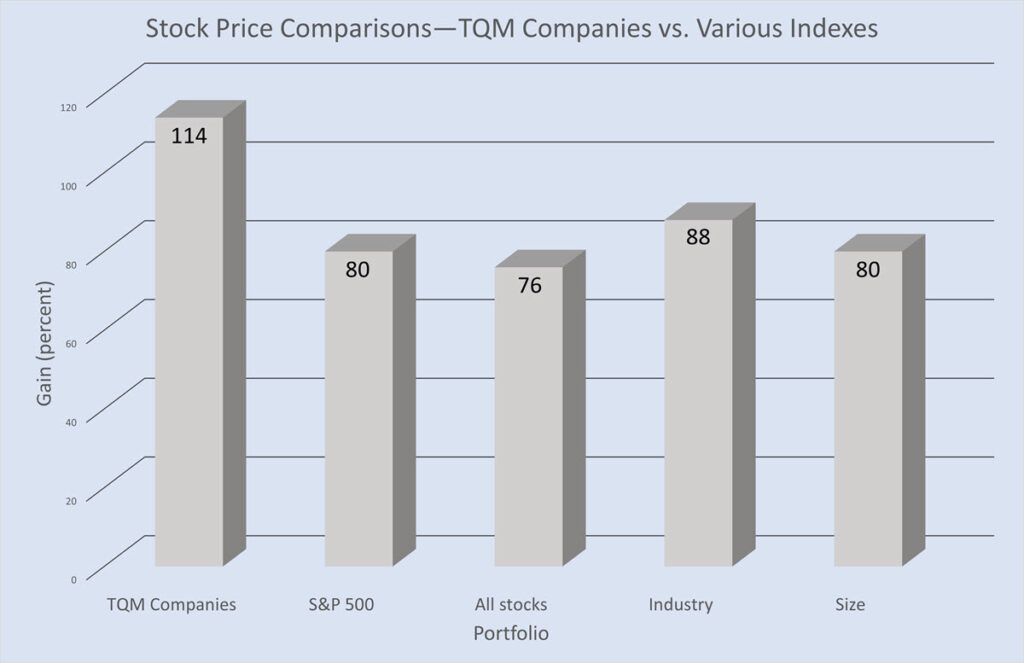

Let’s take a closer look at these issues. Evidence for the first point is entirely anecdotal. The article mentions that Whirlpool does Six Sigma and its stock has fallen by 12 percent during the past two years. So what? GE does Six Sigma too, and its stock price is up seven percent. Meanwhile, the Dow Jones Industrial Average is down four percent. What do these comparisons tell us about Six Sigma? Nothing. Scientific studies of the value of quality improvement initiatives show that the stock of companies that implemented TQM significantly outperformed the indexes (See Figure 1).2 Of course, there are differences between TQM and Six Sigma. Having been intimately involved in both approaches, I know Six Sigma is better than TQM.

The latecomer argument is simply ludicrous. The Fortune article states, “If Whirlpool implements it, and then Maytag does too, who wins? The consumers–those savings will mostly get passed on to them.” Even if we allow the author to argue both sides (Excuse me, but didn’t you just say there weren’t any savings?), the argument fails. If Whirlpool succeeds with Six Sigma and Maytag ignores it, as advised by Fortune, Whirlpool has a cost advantage that can be used to improve its return on investment or to capture additional market share. Latecomers have to implement Six Sigma just to keep up.

To say that Six Sigma focuses on defects is to demonstrate that you don’t really understand what Six Sigma is all about. Unlike TQM, Six Sigma goes beyond defect reduction to emphasize business process improvement in general, which includes cost reduction, cycle-time improvement, increased customer satisfaction and any other metric important to the company. The contention that service defects are, as the Fortune article’s author asserts, “mind-numbingly vague,” will likely come as a particular surprise to my service-industry readers and clients. What’s ambiguous about a customer complaint? A customer leaving you for a competitor? Errors in the customer database? A big drop in the customer satisfaction survey results? I’ll bet even Fortune’s leaders keep track of several quality metrics.

Finally, the article plays the Iridium card to prove that even Six Sigma companies like Motorola can make a mistake. Iridium was to be a satellite-based communication system, but advances in technology and changes in the market rendered it obsolete before it could be deployed.

Motorola should wear Iridium as a badge of honor. It was a daring move that failed. But in the volatile high-tech arena, the big risk is not risk of failure. As an investor, I’d be far more worried about a company that was risk-averse. Six Sigma can’t guarantee success in the marketplace. Nothing can do that. But engaging in truly risky behavior, such as ignoring Six Sigma, can greatly increase the chances of failure.

This article, authored by me, was initially published on Quality Digest. You can access the original post at this link: Quality Digest Article. I’m thankful to Quality Digest for the opportunity to share this piece, and now I’m delighted to be able to bring it to a broader audience on this platform.

References

- Clifford, Lee. “Why You Can Safely Ignore Six Sigma.” Fortune, Jan. 22, 2001.

- Hendricks, Kevin B., and Vinod R. Singhal. “Don’t Count TQM Out.” Quality Progress, April 1999.

- Easton, George S. and Jarrell, Sherry L. “The Effects of Total Quality Management on Corporate Performance.” Journal of Business , Vol. 71, no. 2, 1998.

Leave a Reply