Debunking Six Sigma Criticism: A Rebuttal to Dilbert’s Misstep

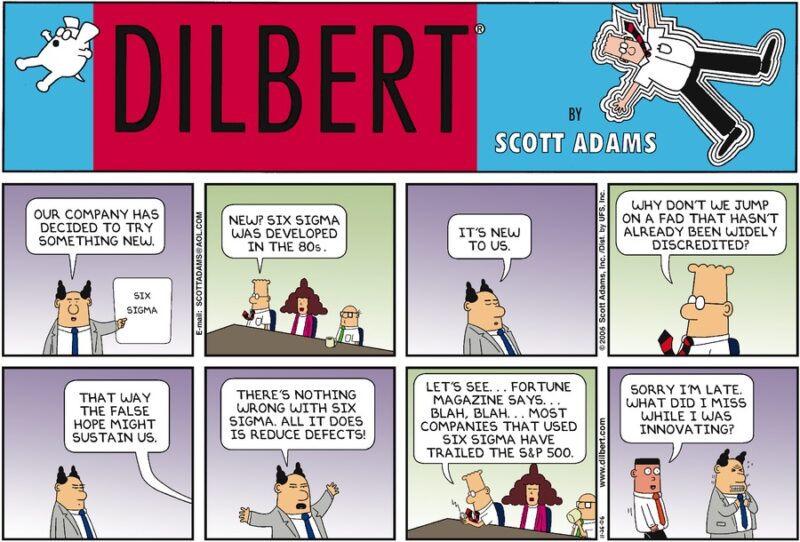

In my previous article, “Ignore Six Sigma at Your Peril,” I critiqued a Fortune magazine article by Lee Clifford entitled “Why You Can Safely Ignore Six Sigma.” As one might expect, my viewpoint ran counter to the article’s argument. Fortune, it appears from the November 26, 2006, Dilbert comic strip, is continuing its campaign.

To clarify, I’m an ardent Dilbert fan. I’ve even set up a Dilbert RSS feed on my Google homepage. But when it comes to reliable business information, Dilbert can sometimes miss the mark. The November 26 strip alludes to a July 11, 2006, Fortune article titled “New Rule: Look Out, Not In,” which cites a study by Charles Holland of QualPro. This study doubts Six Sigma’s effectiveness, but there’s a catch. Holland stated that “58 companies that announced using Six Sigma have trailed the S&P 500” – not that most companies employing Six Sigma have lagged behind.

A count of 58 companies doesn’t provide a representative sample size for all firms employing Six Sigma, even assuming perfect sampling. As a Fortune reporter, I would have probed deeper with questions such as:

- Who are these 58 companies?

- What criteria were used for selection?

- What was the time span from the announcement of Six Sigma deployment to Holland’s performance measurement?

- How did their post-Six Sigma announcement performance compare with their previous performance?

- How did these firms fare compared to other industry counterparts not implementing Six Sigma?

So, is this a genuine research endeavor or a mere marketing strategy? It’s worth noting that QualPro promotes a process improvement program that competes with Six Sigma.

Indeed, serious academic research has been conducted on Six Sigma’s predecessor, Total Quality Management (TQM). The study “The Long-Run Stock Performance of Firms with Effective TQM Programs” (Management Science, Vol. 47, No. 3) demonstrates that companies implementing TQM witnessed improved stock performance, operating income, sales, total assets, employment growth, return on sales, and return on assets relative to their non-TQM counterparts. The study was based on a large sample size and employed a systematic selection criteria. Furthermore, it compared performance for five years before and after the TQM deployment.

The underlying flaw in the Fortune article is the idea that companies must pick between innovation and process excellence. Any firm that exclusively focuses on Six Sigma to the detriment of innovation, or vice versa, is destined for failure. I don’t contend that Six Sigma is the sole key to business success. Numerous successful companies thrive without it. However, unless a company enjoys unique competitive advantages such as extremely low labor costs or a government monopoly, long-term success is impossible without any regard for process excellence. Ignoring this aspect opens the door for more efficient competitors to swoop in, potentially luring away investors, customers, and employees. Companies’ tendency to fixate on a single business aspect is misguided and can lead to seemingly erratic management shifts from one initiative to another, providing ample fodder for Dilbert.

For an audio discussion on this topic, visit my podcast at https://www.pyzdekinstitute.com/blog/podcast/dilbert-got-it-wrong.html.